The housing market right now is absolutely no joke. Whether you’re looking to rent or own, prices for any kind of housing are sky-high as the housing bubble inflates. So, any rent increase will hurt tenants as the fight for cheap housing grows harder. But what happens if your landlord only gives you a month’s notice about a rent increase?

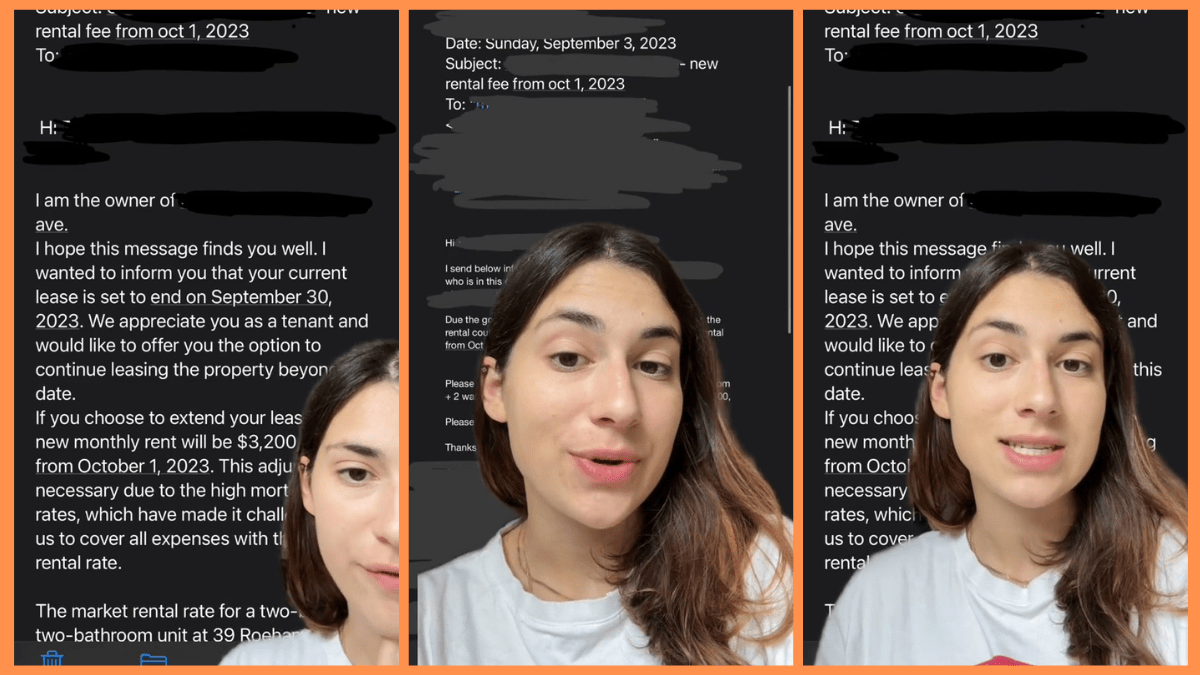

TikTok user @aserealty dove into the reality that some renters are facing right now as she discussed her client’s specific situation. Anya Ettinger is a Toronto-based real estate agent who is helping out a client who was notified less than a month before her lease was up of a major hike in rent. According to Anya, her clients were notified on Sept. 3 that their 2-bedroom apartment would be increasing to CAD 3200 as of Oct. 1 from the original amount of CAD 2900. Initially notified by a listing agent on behalf of the landlord, they were then emailed by the landlord himself, allegedly for the first time since leasing the apartment.

In his email, he says that since the tenants’ lease ends on Sept. 30, the rent increase would occur when the lease resets on Oct. 1. If they choose not to agree to the rent increase, they need to relocate by Oct. 1, as the landlord would be looking for a new tenant to move in on that day. Naturally, Anya tears into the behavior of both the landlord and listing agent as they clearly ignore the Residential Tenancies Act that affects all rentals in the providence of Ontario.

While the legislation can vary from state to state, let alone country to country, most states or countries have some kind of policy in place stating how landlords go about a rent increase. Using the RTA in Ontario as an example, a landlord must give 90 days’ notice for a rent increase and can only increase rent once within a 12-month period.

While Anya goes into this point in the original video, multiple other videos on her page mention the risk landlords take when buying property for renting it out. As she puts it, “A variable rate mortgage is a risk. If you take that risk, you must be prepared for the consequences.” She then states that it’s not the tenant’s responsibility to have to pay more to make up for the higher mortgage payments. Anya communicated with her client’s landlord and got them to understand the mistake made in their rental increase request.

Many of the comments were amazed at how ridiculous the whole situation was, in addition to the rent crisis in general, as people take desperate measures to find a roof over their heads. One commenter made the fair point, “Why do landlords think tenants should pay ALL the expenses of their home ownership?” Another suggested that “100 percent if your mortgage is too high and you can’t cover it, then sell it.” However, one commenter nailed the main issue on the head: “Would my rent go down when interest rates go down? Absolutely not.” Hopefully, these tenants can find a better landlord, though.